The Anatomy of a Flash Crash, Modeled to the Millisecond

29 Jul 2025

Agent-based simulator models flash crash events like 2010’s using high-frequency trading data and explores key market conditions behind such volatility.

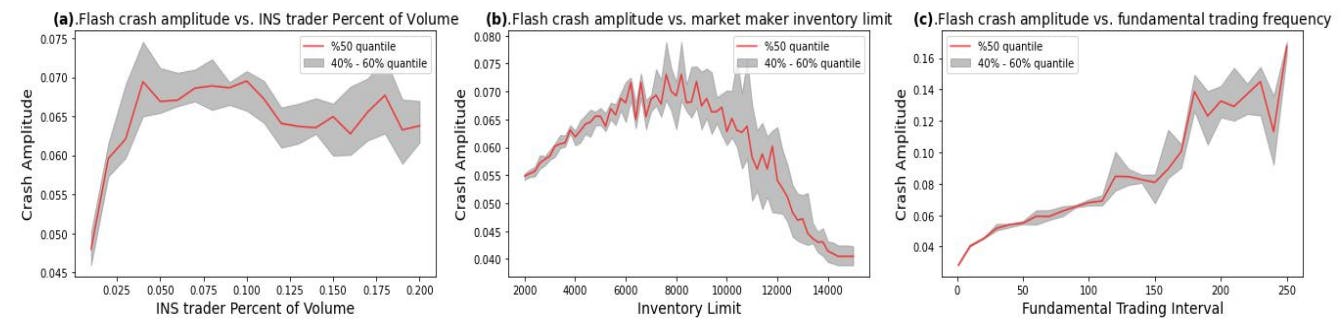

How Trading Algorithms Can Trigger Flash Crashes

29 Jul 2025

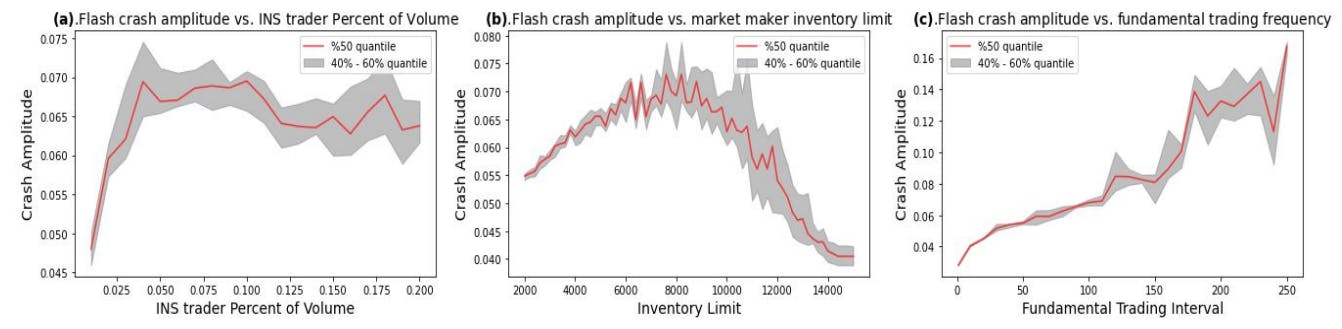

Simulations show how algorithmic trading, inventory limits, and trader speed drive flash crashes—and why real markets may be more fragile than we think.

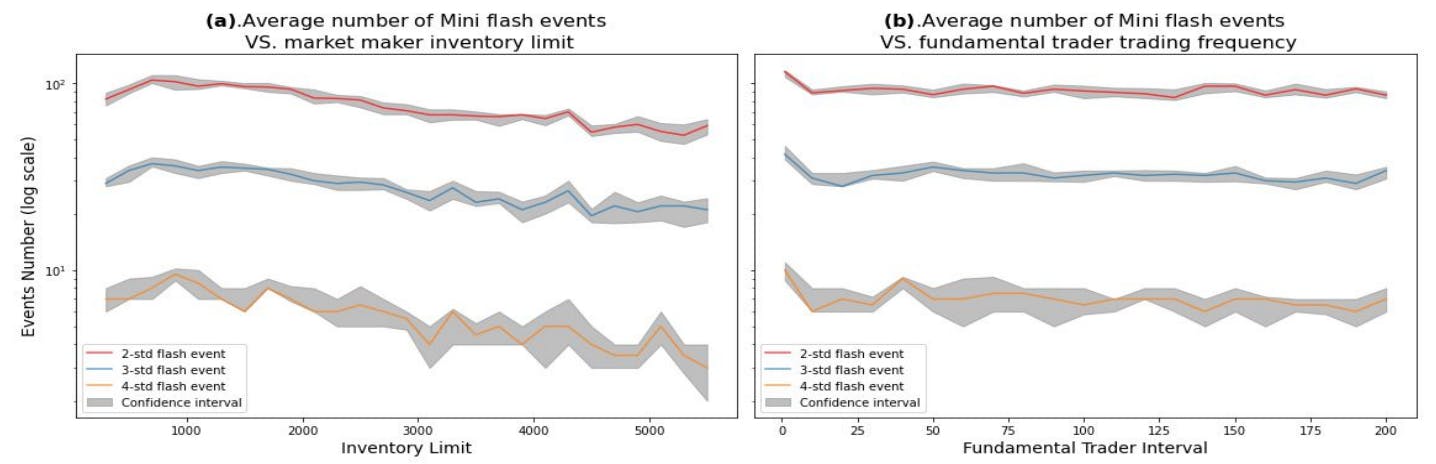

Why Tiny Crashes Happen All the Time, and What They Reveal About Modern Markets

29 Jul 2025

Simulated study reveals how market maker limits and trading frequency affect the frequency and severity of mini flash crash events.

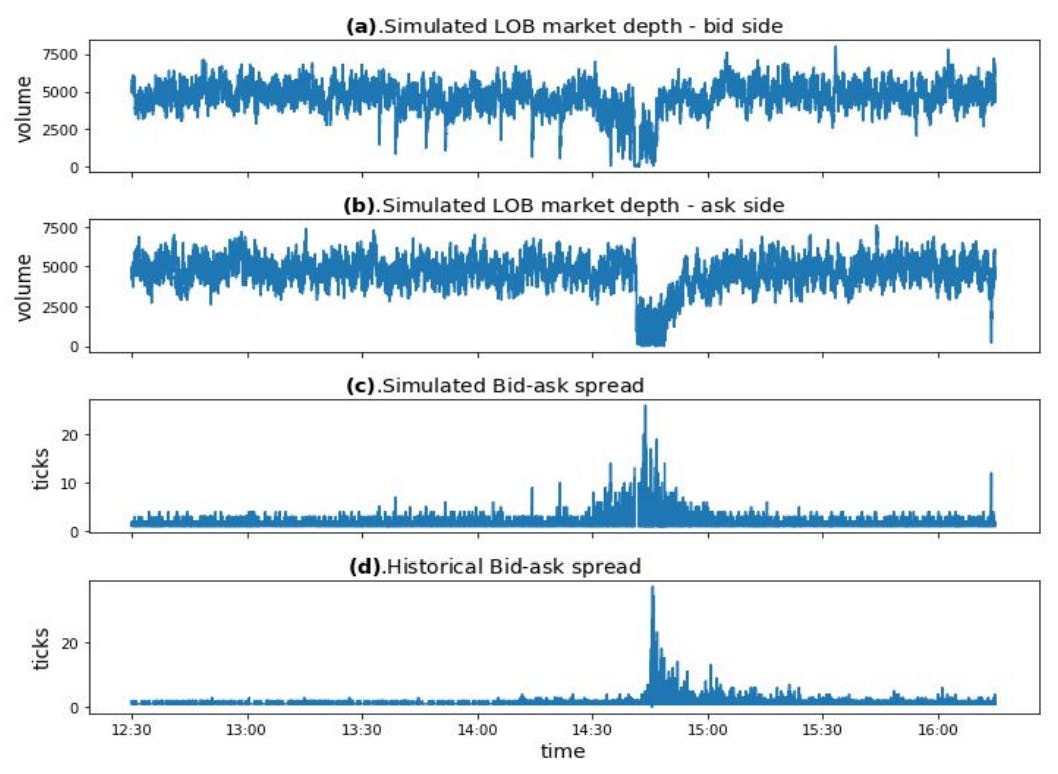

The Mechanics of a Mini Flash Crash

29 Jul 2025

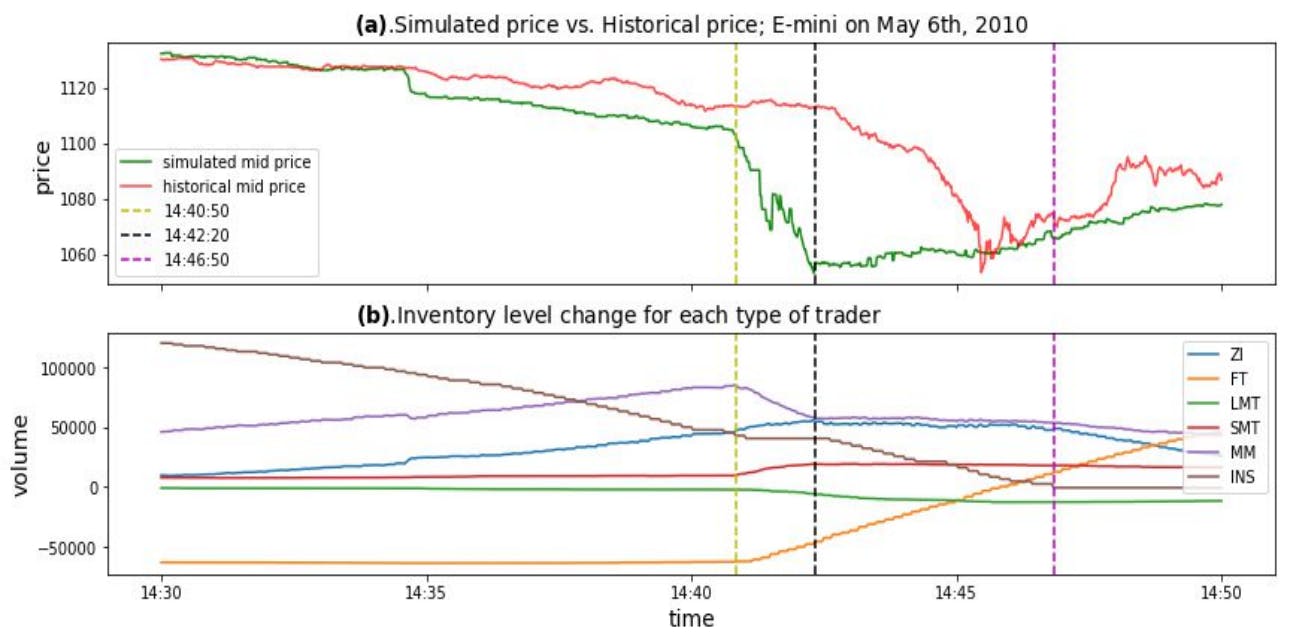

Why Did the Stock Market Crash in 2010?

28 Jul 2025

A simulation of the 2010 Flash Crash reveals how algorithmic trading and liquidity withdrawal led to one of the most dramatic market drops in history.

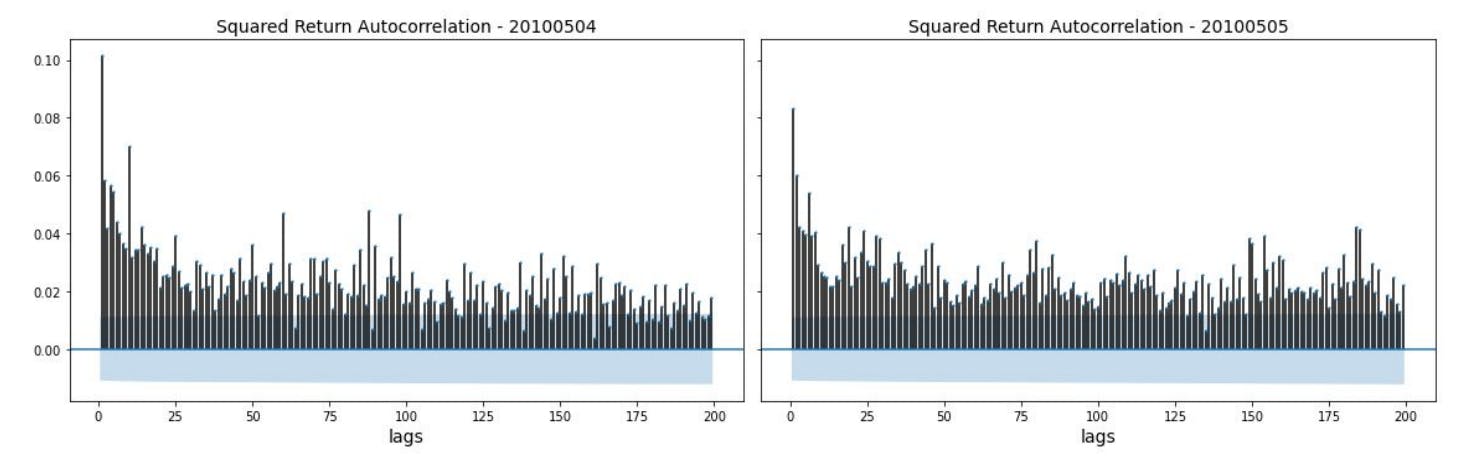

Can a Financial Model Truly Mimic Reality? These Numbers Say Yes

28 Jul 2025

Statistical tests show our calibrated model mirrors real financial data. P-values and coverage ratios confirm its accuracy and realism.

Validation-Driven Calibration of Financial Simulation Models

28 Jul 2025

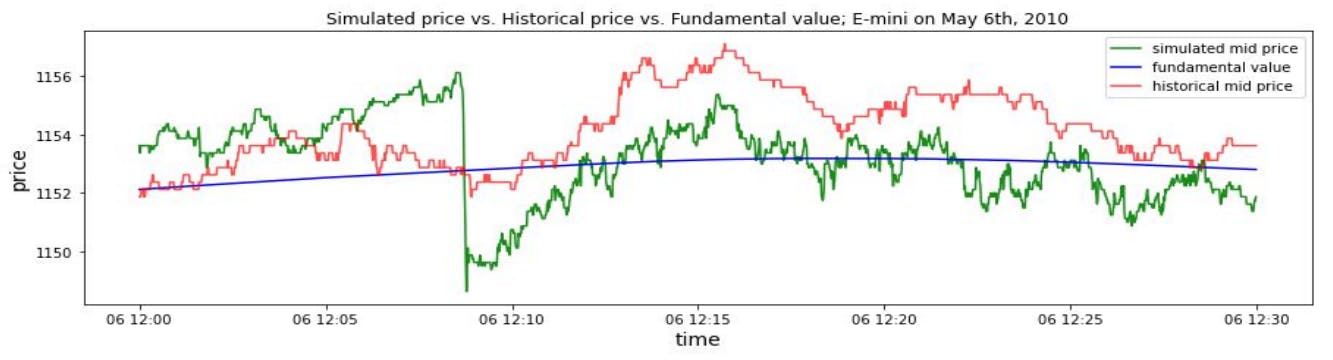

Surrogate models and grid search combine to calibrate an agent-based financial simulation that mirrors real mid-price market dynamics.

How Stylised Facts Shape the Future of Financial Market Simulation

28 Jul 2025

How we calibrate and validate financial market models using stylised facts like fat tails, volatility clustering, and return autocorrelation.

Agent-Based Modelling of Market Microstructure

28 Jul 2025

Explore how five types of traders—including market makers—shape realistic trading simulations using order books, position limits, and Kalman smoothing.